Why Property?

There is no doubt that for centuries, the UK property market has been the perfect environment for wealth creation. The explosion in the house ownership population from the 1980’s onwards, renewed interest in the property sector as a preferred investment vehicle due to the almost guaranteed long-term return on investment and the yield potential available of the rental sector.

In the last 60 years, there has never been a single 15-year cycle in the UK where average residential property prices did not rise by a minimum 40%. Property performs better than almost every other asset class available to the UK

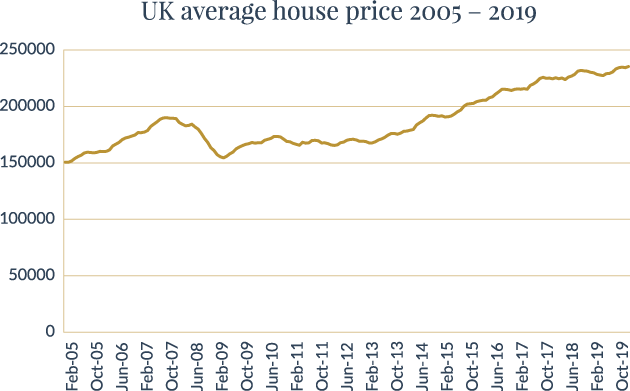

For example, average property prices in 2005 started at £150,000 and 15 years later had reached £235k, an increase of 56%. it is worth remembering that in the UK, the period from 2005-2019 contained the world banking collapse circa 2008, 2 separate periods of recession & a 10-year period of austerity and public spending cuts from 2001. Yet despite the economic challenges of the UK, the property sector delivered 56% growth to residential owners, far higher than ISA’s and pensions and with considerably less risk than stocks and shares.

Then there is the rental potential to consider in addition to the growth. Depending on your strategy, location and requirements, your property can also deliver you cash in the bank every month on top of the growth potential. You do have to know what you are doing and there is a lot to consider if you intend to hold your investment long term, but the rewards can provide a secondary income or indeed an entirely new career depending on your plan

The UK property market’s accessibility together with its high growth and low risk credentials, serves as the perfect asset class for both casual and professional investors alike.

Prospective investors must of course complete research and due diligence processes before committing to purchasing and there are multiple considerations to contemplate. Your strategy, funding, expertise, experience, risk profile, project management abilities and budget must all be meticulously planned if your project is going to be delivered on time and on budget

We at Property Portfolio Management Ltd manage multiple strategies of our own so have an acute understanding of the requirements to be successful on your own property journey. Why not give us a call if you want to find out more

General risk Warning: The past performance of any investment is not necessarily a guide to future performance. The value of investments or income from them may go down as well as up.